Over the past couple of seasons, Charlotte residents often chose to buy rather than rent because of the “once-in-a-lifetime” combination of low prices and low interest rates. Factor in the reality that homes typically offer much more space than apartments, and the equation was persuasive, to say the least.

However, the data now suggests that rentals are actually increasing as a percentage of all occupied housing units in Charlotte. As of September 2013, the fraction of housing units occupied by renters stands at 35.69-percent. This figure represents a year-over-year increase of 1.78-percent. Put another way, Charlotte residents are choosing to rent rather than buy about five-percent more often than just a year ago. This increased demand probably drives some of the increased rents noted above.

Higher Interest Rates Have an Impact

Rising mortgage rates certainly factor into the equation. In September, the average 30-year fixed mortgage carried an interest rate of 4.80-percent. This was a full point higher than the average of 3.75-percent posted 12-months earlier, per the Mortgage Bankers Association. Essentially, money is about 25-percent more costly that it was a year ago. This significantly impacts the classic rent vs. buy question. In the largest 100 markets in the country, including Charlotte, it is estimated that buying is 35-percent cheaper than renting as of October 2013. This compares to a gap of 45-percent one year ago. Of course, the buyer’s advantage comes with one key caveat: “if you qualify.” Higher sub-prime rates can quickly erase much of the advantage. Others simply do not have the credit and/or the down payment to purchase in any case.

Current Rent Data

As of October, 2013, the average apartment rent within 10 miles of Charlotte, NC is $937. One-bedroom apartments in Charlotte rent for $809 a month on average and two-bedroom apartment rents average $975. Month-to-month anomalies can readily occur because of the fact that the statistical samples are not all that large. Therefore, it’s more insightful to look at six-month or one-year trends. Rental statistics compiled within Charlotte proper, and within 10-miles of the city, do suggest an upward trend in rents.

However, this trend is more pronounced among the two-bedroom apartments. For example, rents associated with one-bedroom units have fluctuated within a relatively narrow range over the past year. For the 12-months ending October 2013, such rents have ranged between $738 and $810. The difference of $72 per month is not probably significant enough to change the thinking of those in the market for one-bedroom units. However, the larger two-bedroom units offer a different view. Over the past 12-months, two-bedroom rents has ranged from a low of $856 to a high of $975. One could argue that the difference of $119 might be significant enough to drive some people toward other options.

Those that require the flexibility that renting offers will certainly need to pay those slightly higher rents. It’s not ordinarily financially advantageous to buy a home only to turn around and sell it in a year or two. The time investment can be considerable as well. There may be instances where rising home prices make such a move profitable, but such scenarios will be the exception rather than the rule. However, those that do not plan to remain in a home for at least a number of years will find that the financial advantages of buying are quickly muted anyhow.

More Buying Than Renting in the Near-Term?

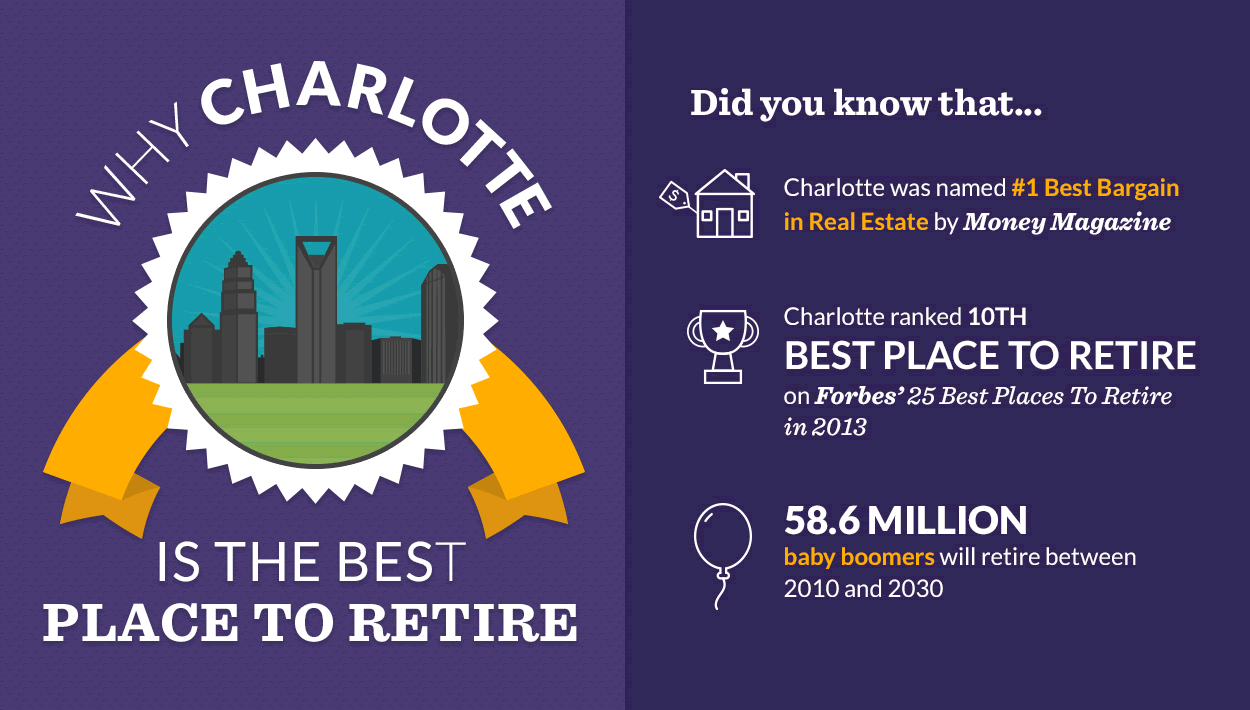

Considering all factors, the preference may tilt in favor of buying in the coming months. Slightly lower mortgage rates will make buying somewhat more attractive, while higher rents will drive some away from renting. Still, residential real estate prices have rebounded more quickly in Charlotte than in many other metro areas, thus reducing the “buyer’s advantage” somewhat. Year-over-year prices are up 7.1 percent as of October 2013. At the same time, available inventory continues to be in short supply. This does raise the question: to what degree are home prices rising because of a temporary shortage of supply? Ultimately, a current shortage of relevant inventory may support the decision to rent as well.